The FTSE Finish Line - November 12 - 2024

The FTSE Finish Line - November 12 - 2024

FTSE Falls Again After Yesterday’s Dead Cat Bounce

The FTSE in London is down more than 1%. Concerns about the expansion of the Chinese economy are hurting miners and luxury companies, which are both down around 2%. The only industry in the green is defence. On the macro side the Labour Force Survey showed the unemployment rate rose to 4.3% from 4.0%, higher than expected, but sampling issues and base effects may have contributed. Average earnings growth was firmer than expected at 4.3% 3m/y, in line with the BoE's projection. However, the HMRC median pay series showed a spike to 7% y/y, reflecting recent NHS pay settlements. The mixed data presents a challenge for the MPC, with rising unemployment and firm pay growth signals. The impact of the employer NICs changes announced in the Budget will be closely watched.

Single Stock Stories:

Vodafone, a UK-based mobile operator, experienced a 3.7% drop in its share price to 70.28p, making it one of the top losers on London's benchmark index. This decline was attributed to weakness in its largest market, Germany, where service revenue declined by 6.2% in the second quarter due to a lower customer base. However, the overall group revenue increased by 1.6% to 18.3 billion euros ($19.45 billion) in the first half of the year. Vodafone reiterated its fiscal year 2025 guidance, expecting core earnings of around 11 billion euros and adjusted free cash flow of at least 2.4 billion euros. Additionally, the company reported a 3.8% rise in adjusted core earnings to 5.4 billion euros, in line with market consensus. Vodafone's shares have risen approximately 3% year-to-date.

Convatec Group Plc's shares surge up to 19.2% to 258.2p, leading the FTSE 100 index. The medical products and technologies company raises its fiscal year 2024 organic sales growth forecast to 7.25%-8% from the previous guidance of 6%-7%. It also expects the fiscal year 2024 adjusted operating margin to be more than or equal to 21.5%, higher than the prior expectations of 21%. The London-based company anticipates further expanding its operating margin and delivering double-digit adjusted earnings per share and free cash flow to equity growth in fiscal year 2025. The year-to-date organic sales growth has risen to 7.7%, and the company's shares have increased by around 6% year-to-date.

Broker Updates:

Vistry Group's shares fall up to 6.4% to 707.50p, as UBS cuts target price to 605p and rates "sell", and Citigroup slashes target price to 843p and rates "neutral". Vistry's balance sheet is "looking stretched and presents potential downside risk", and a combination of cost issues in the South Division and concerns of a demand slowdown have driven the recent sell-off. The stock is down 5.7% as of 1220 GMT, pushing year-to-date losses to 22%.

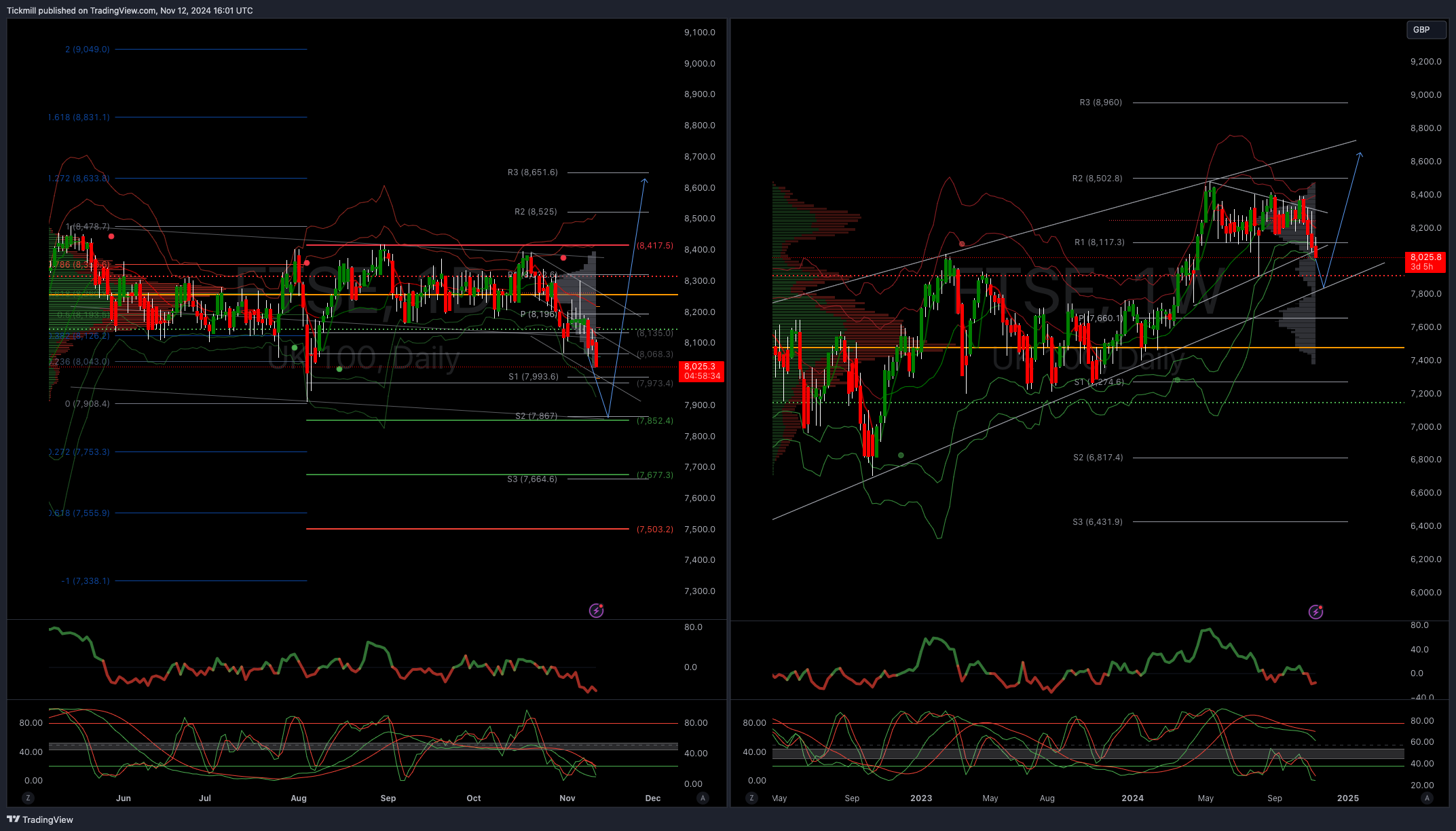

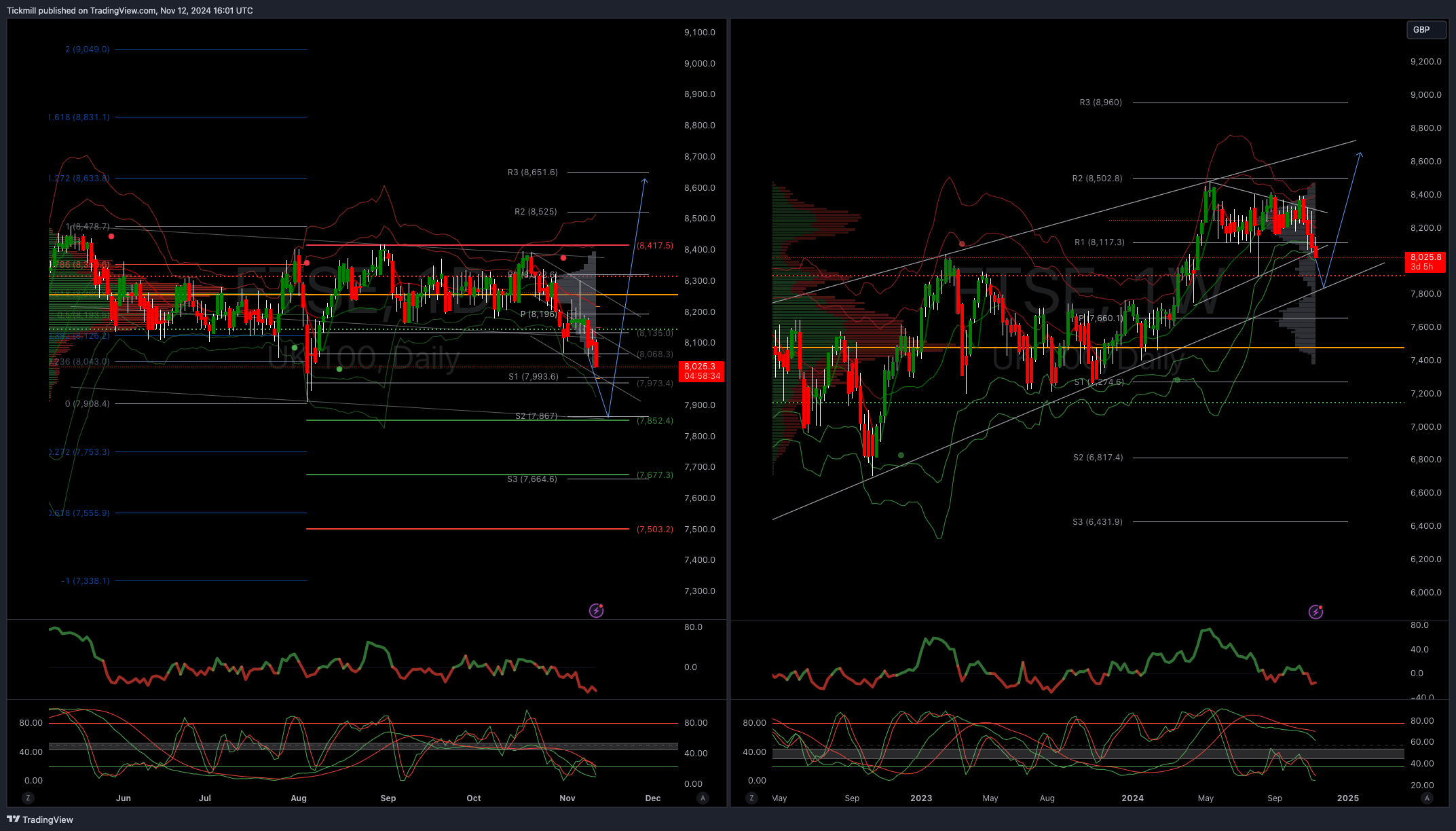

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!