The FTSE Finish Line - November 18 - 2024

The FTSE Finish Line - November 18 - 2024

FTSE Sees A Slow Start To The Week, As 8k Support Remains Under Scrutiny

UK's main stock indexes traded in a narrow range on Monday, as investors remained cautious ahead of an upcoming inflation report, while conglomerate Melrose saw a jump following a positive trading update. In a subdued start to the week, the FTSE 100 index edged up 0.2%, supported by gains in precious metal miners as gold prices recovered. The midcap FTSE 250, which includes more domestically-focused companies, declined 0.1%, ahead of the release of October inflation data expected on Wednesday. Most market participants, according to data compiled by LSEG, have priced in the expectation that the Bank of England could leave interest rates unchanged at its final meeting of the year in December, despite signs of the economy contracting.The main indexes recorded losses in the previous week, with the FTSE 100 registering its fourth consecutive week of declines.

Single Stock Stories:

Shares of UK company Cerillion rose 2.13%. The billing, charging and customer relationship management software solutions provider reports fiscal year adjusted pre-tax profit of 19.8 million pounds, exceeding analysts' estimate of 18.6 million pounds. The company also reports fiscal year revenue of 43.8 million pounds versus a consensus estimate of 44 million pounds. Broker Canaccord Genuity says there is "plenty of scope for further market share gains with its broad 'out-of-the-box' software offering." At least three brokerages raise their price target after the fiscal year results. Six of seven brokerages rate the stock "buy" or higher and one "hold"; their median price target is 2,000 pence. The stock had risen around 20% year-to-date as of the previous Friday's close.

Shares of aerospace components supplier Melrose Industries rose 7%, reaching their highest level since August 1, 2024. The stock is the top gainer on the FTSE 100 index, which is up 0.1%. MRON reports 7% growth in revenue for the four-month period ended October 31 and maintains its full-year expectations, with adjusted operating profit expected to be between 550 million pounds and 570 million pounds. However, the stock is still down 13.7% year-to-date as of the last close.

Technical & Trade View

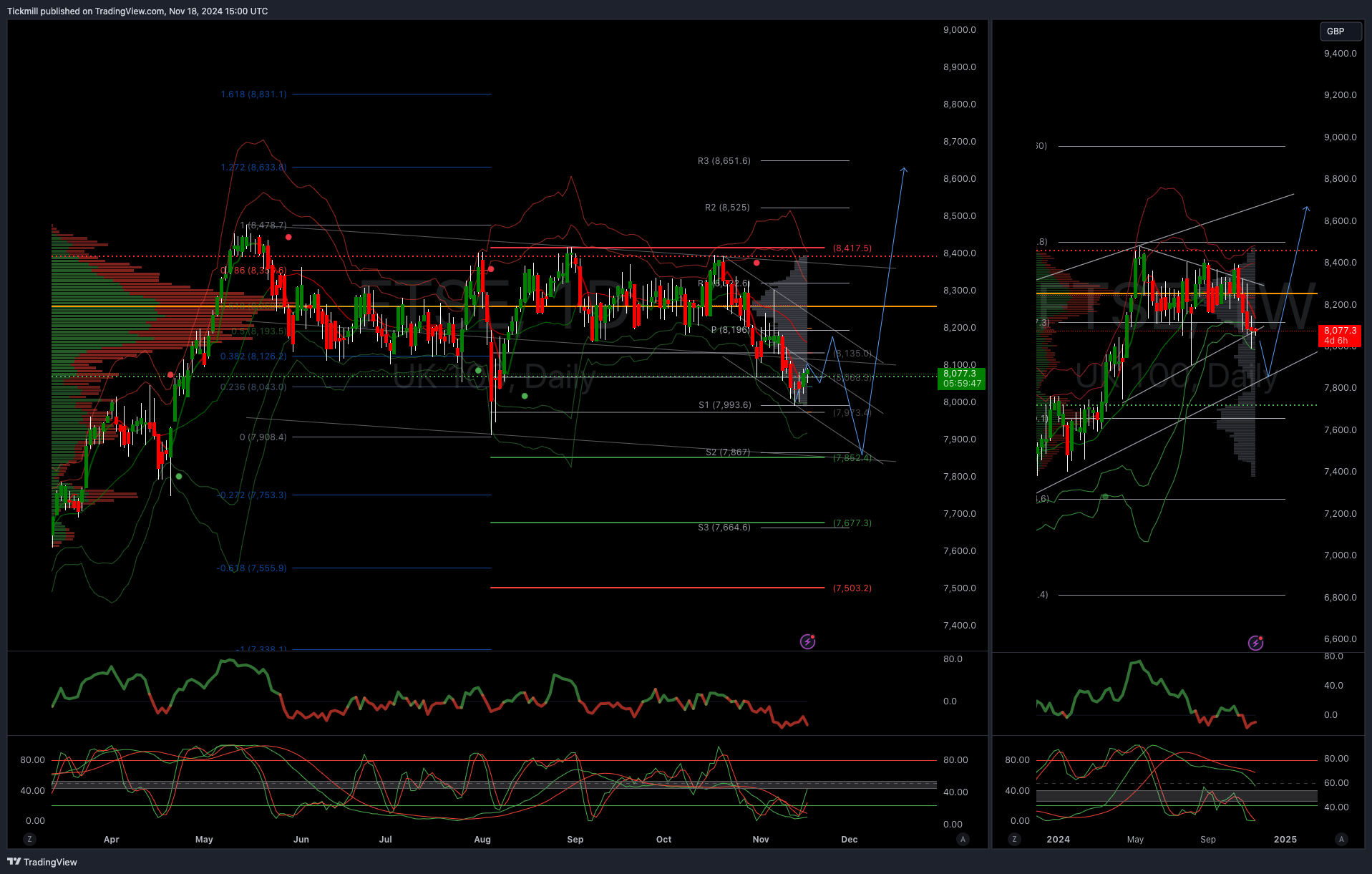

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!