The IndeX Files 28-09-2021

Risk Aversion Deepening On Inflation Fears

Benchmark global equities indices have started the week under pressure with selling seen across Monday and over the European open on Tuesday. The resurgence in the US Dollar along with broader risk-aversion is seeing the four indices tracked here potentially carving out lower highs against the YTD peaks. Contagion fears around the ongoing Evergrande crisis are continuing to dog markets here with. Additionally, a spate of more hawkish comments from Fed members yesterday is helping lift USD and is once again putting a stronger focus on Fed tapering.

Among the Fed members yesterday who commented on inflation and the need for tapering was NY Fed president Williams (typically more dovish) who now also concludes that tapering “may soon be warranted”, highlighting the more hawkish shift in the Fed. On the back of last week’s more hawkish message from the BOE, investors are spooked around the potential reduction in QE over coming months.

Looking ahead today the big focus will be on comments due from Fed chairman Powell. In light of the hawkish shift seen from other Fed members, there are clear upside USD risks heading into today’s comments, which hold the potential to driver equities markets lower still.

Technical Views

DAX

The sell off in the DAX this week is seeing the market probing below the 15486.96 level as of writing. With indicators both turned lower, there are risks of a continuation lower here putting the focus back on the 15078.83 level. To the topside, bulls will need to see price back above the 15743.01 level to alleviate near term bearishness.

S&P500

The current sell-off from the 4475.25 highs is potentially a very bearish development for the market, carving out a lower high against the 4545.25 highs. With indicators both turned lower here, a break below the 4383.50 level will turn the focus back to the 4295.75 level, a break of which will signal a trend reversal lower in the medium term.

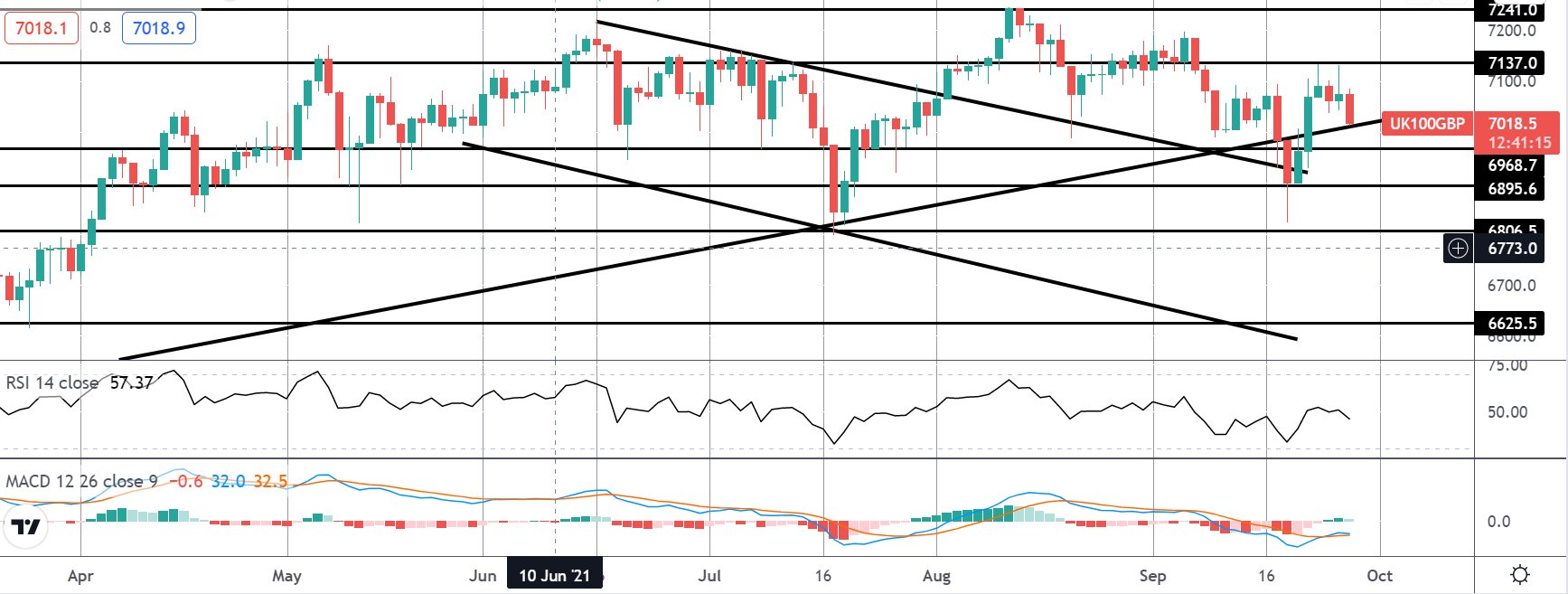

FTSE

Following the recent failure at the 7137 level, price is now testing the bullish trend line from YTD lows. With indicators just about still in the green here, bulls will need to see this region (extending down to support at 6968.7) hold. Below there, however, the focus will turn to 6895.6 and 6806.5 thereafter.

NIKKEI

The index is in a very interesting place technically. The recent test of the 30502.8 level now risks becoming a double top formation if price breaks below the 29464.9 level. Bulls will need to defend this level to keep the focus on further upside. Below there, the focus will shift to the broken bear trend line and deeper support at the 28356.6 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.