US Data Surprises on the Upside, Confirming Fed Concerns about Inflation Rebound

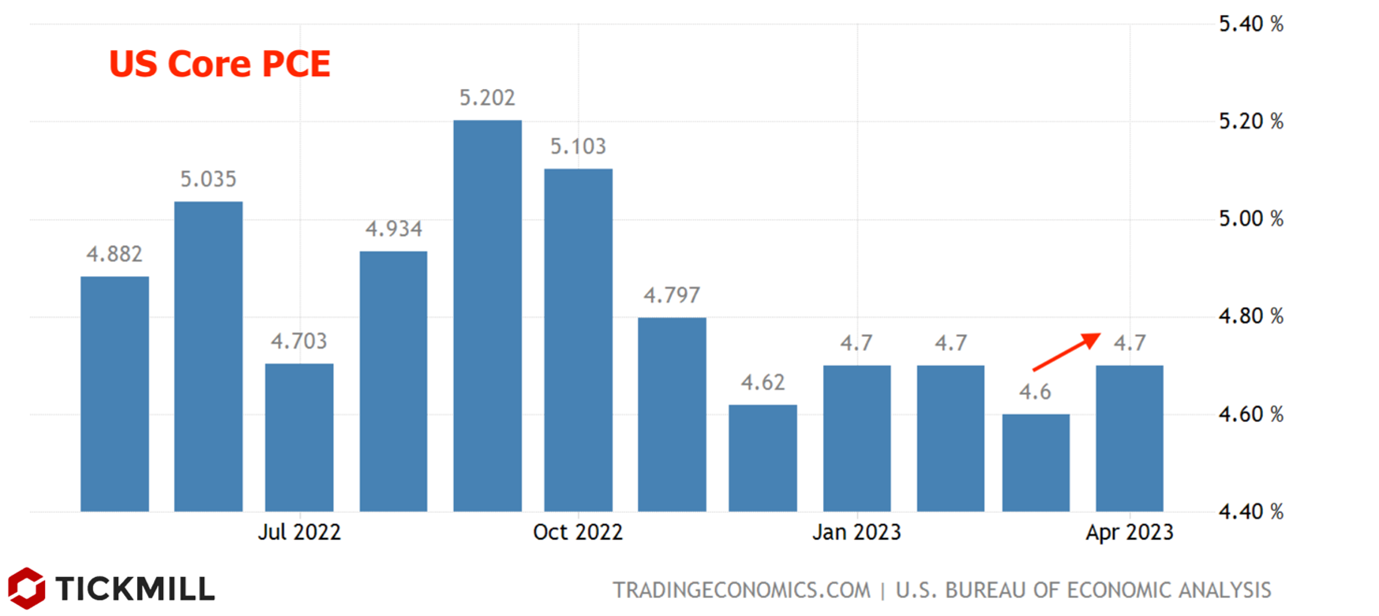

Core PCE for April confirmed market concerns that consumer inflation in the US is accelerating again:

Overall, it is not surprising as top Federal Reserve officials complained about sustained high inflation throughout the past week. They argued that interest rates should be higher, and some officials even hinted quite transparently about their voting intentions in June. This behavior is atypical and even risky for central bank officials, as they consciously risk losing flexibility in their response, which could result in significant costs (loss of credibility leads to a less predictable response to policy decisions) if incoming data suggests otherwise. Nevertheless, the Core PCE, the first-quarter GDP estimate, and other data have put everything in its place.

Regarding the assessment of US GDP data for the first quarter (the second estimate), output growth also exceeded expectations, reaching 1.3% compared to a forecast of 1.1%. Once again, consumer demand stood out with strong growth. This is the component that the Fed can and should suppress with a higher interest rate to achieve its inflation target. Consequently, the pressure on the Fed to raise rates has increased further after the report.

Other data, such as jobless claims and durable goods orders, also exceeded expectations in a positive sense.

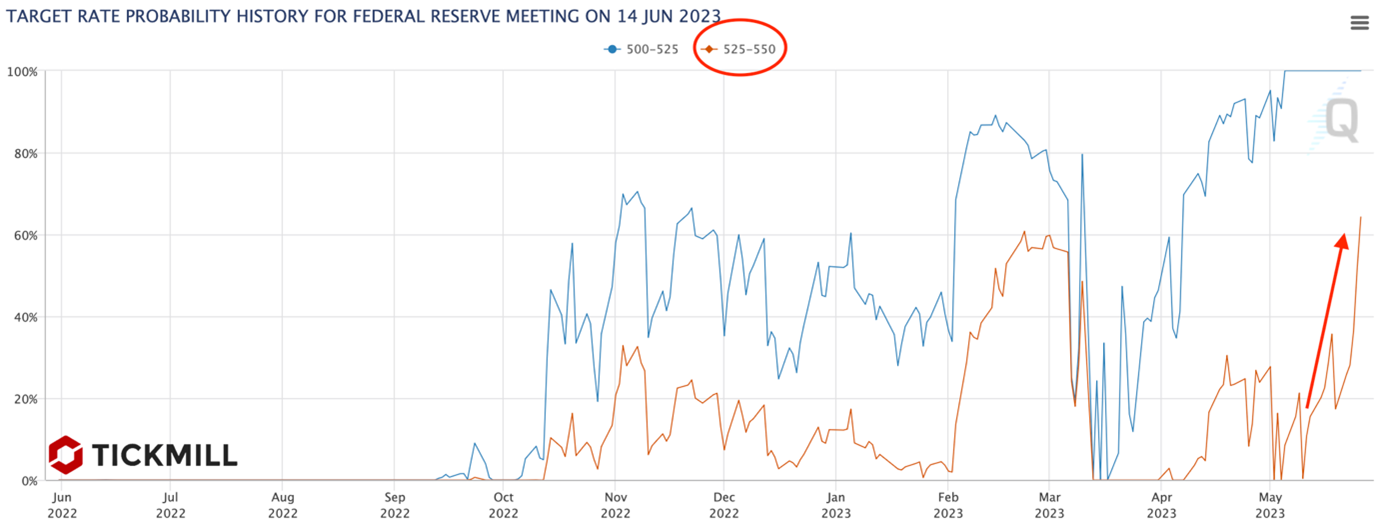

The chances of a tightening in June, as priced in by interest rate futures market, have risen to 66%. Just twenty days ago, the chances did not exceed 1%, meaning this outcome was not seriously considered:

This Monday, there is a calm atmosphere as the market has largely priced in the aggressive move by the Fed in June. Therefore, entering long positions on the dollar or shorting gold in the first half of the week can be risky. Most likely, there will be a slight correction of the previous week's movements. The overall target for gold seems to be achieved, and a rebound from the lower boundary of the trend channel and the 50-day moving average is looming:

On Friday, the US unemployment report for May is expected. Considering the obvious positive momentum in the economy, the risks are skewed towards stronger readings than the forecast. The market will likely try to factor this in. This should be reflected in a resumption of long positions on the dollar and short positions on gold. Therefore, breaking the lower boundary of the trend channel remains a relevant idea, but for the second half of the week. EURUSD may rise before the inflation report for May (scheduled for Thursday), but it is unlikely to offer the market anything more interesting than the Non-Farm Payrolls (NFP) report at the moment. Therefore, as a catalyst for strengthening the Euro, the inflation report may prove to be short-lived.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.