Yen Rallies on Stronger Tokyo Inflation

Yen Rises

Despite a generally stronger US Dollar on Friday, JPY is giving the greenback a run for its money following strong Japanese inflation data overnight. Tokyo core CPI was seen rising to 3.6% from 3.4% prior, above the 3.5% the market was looking for. The data keeps hawkish BOJ expectations entrenched here, underpinning JPY. The market is currently expecting the BOJ to hike rates by a further .25% when it meets next month.

BOJ Governor Speaks

We heard some interesting comments from BOJ governor Ueda today. Ueda explained that the recent downgrade to the bank’s inflation forecasts reflected factors such as rising geopolitical risks as well as ongoing trade uncertainty and weaker oil prices. However, Ueda noted that this is a longer-term view and the downgrade wouldn’t impact the bank’s near-term decision making. In short, the market has taken this as a sign that Ueda is keeping the door open to further tightening near-term, despite the lower long-term inflation view.

Bullish JPY View

Given these hawkish BOJ expectations and the residual safe-haven support commanded by JPY, the Yen has room to push higher near-term. Uncertainty around the US trade war remains a key threat to global risk sentiment and news this week that US/China trade talks have stalled could pave the way for higher JPY prices if we see any further negative headlines.

Technical Views

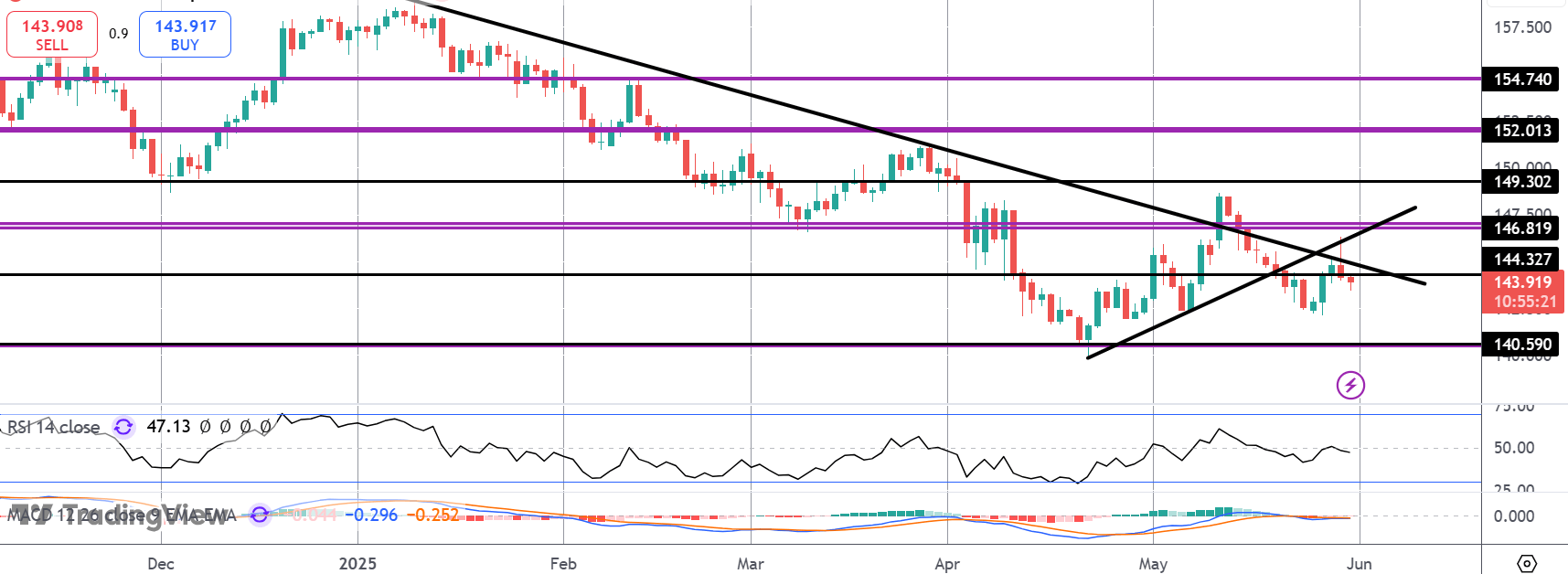

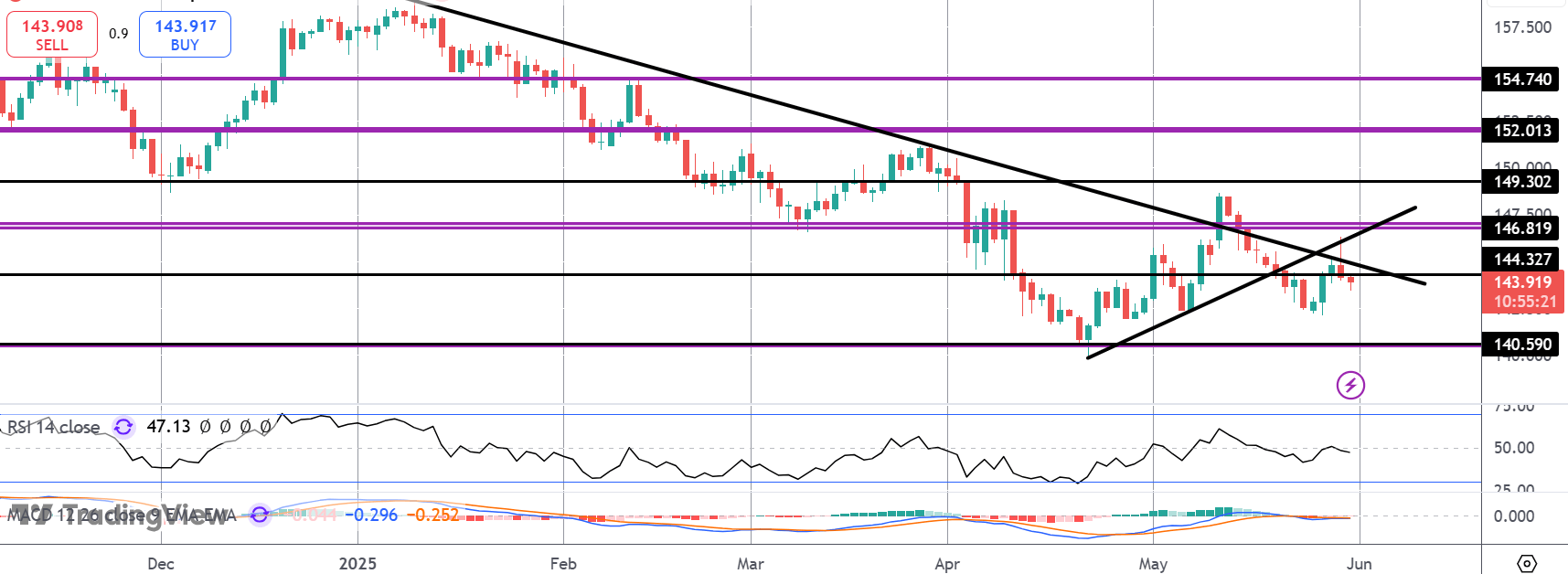

USDJPY

For now, the pair remains capped by the retest of the broken bull trend line from YTD lows and the bear trend line from YTD highs. While this resistance region holds, a fresh test of those YTD lows around 140.59 is viable, particularly given weak momentum studies readings. Bulls need to break back above 146.81 to alleviate these near-term risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.