SP500 LDN TRADING UPDATE 6/10/25

.jpg)

SP500 LDN TRADING UPDATE 6/10/25

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT ~60 POINTS***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

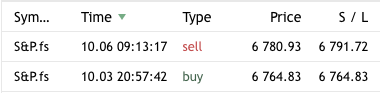

WEEKLY BULL BEAR ZONE 6720/10

WEEKLY RANGE RES 6791 SUP 6640

OCT EOM STRADDLE 6602/6891

OCT MOPEX 6842/6487

DEC QOPEX 6303/7025

DAILY VWAP BULLISH 6749

WEEKLY VWAP BULLISH 6655

DAILY ONE TIME FRAMING HIGHER - 6754

WEEKLY ONE TIME FRAMING HIGHER - 6693

MONTHLY ONE TIME FRAMING UP - 6371

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

Weekly Market Overview

The S&P 500 rose by 1% this week as investors processed the implications of a potential federal government shutdown, new drug pricing policies, and ongoing volatility among megacap stocks ahead of the upcoming OpenAI Developer Day on Monday. While overall desk flows were benign, with long-only funds slightly net buying and hedge funds remaining flat, single stock volatility was notable.

Key Highlights

Healthcare Sector Activity: The healthcare sector experienced significant movement, particularly in pharmaceuticals, which had its best week in over a decade following the Most Favored Nation (MFN) drug pricing deal. This led to increased demand, predominantly driven by hedge funds.

Market Dynamics: Despite frustrations with price action, certain stocks, particularly those heavily shorted, outperformed. For instance, Goldman Sachs' most shorted stocks outperformed their hedge fund VIP long counterparts by approximately 15% over the past month. Our Short Interest Pair (GSPUWSHI) is having its best month since the meme stock frenzy of 2021.

Investor Sentiment: There is a prevailing belief that the current rally has momentum and could extend into Q4 as investors who missed earlier gains may start chasing returns. Historical trends suggest that sharp squeezes often continue in the near term without signaling imminent declines in the S&P 500.

Sector Performance

Best Performers:

Bitcoin Sensitives

Quantum Computing

Obesity Drugs (all up over 10%)

Worst Performers:

Oil (-4%)

Regional Banks (-1%)

Low-Income Discretionary (flat)

Fund Flows and Leverage

Gross and Net Leverage: US Fundamental Long/Short (L/S) gross leverage increased by 3.1 percentage points to 217.7%, reaching the 100th percentile over the past three years. Net leverage rose by 1.9 percentage points to 52.5%, sitting at the 48th percentile.

Hedge Fund Activity: Hedge funds net bought US equities this week, focusing on long positions in macro products while covering shorts in single stocks for the second consecutive week after eight weeks of increased shorting. The healthcare sector saw the most net buying, while consumer discretionary stocks experienced unwinding of gross risk for the first time in seven weeks.

Upcoming Events

Looking ahead, the S&P 500 is expected to have an implied move of 1.10% through next Friday (10/10). Key events to watch include:

Weekend Developments: Headlines from Japan’s LDP leadership contest and the OPEC+ meeting, along with updates on the US government shutdown.

Fed Speakers: A busy week of Federal Reserve speakers is anticipated, with macro data likely impacted by the Bureau of Labor Statistics shutdown.

FOMC Minutes: The release of the FOMC meeting minutes on Wednesday will be closely monitored, along with notable treasury auctions throughout the week.

Sector-Specific Insights

TMT (Technology, Media, Telecommunications)

The NDX index finished up over 1% for the week, achieving new all-time highs. The focus remains on the momentum in AI infrastructure and semiconductor stocks, highlighted by the SOX index’s 5% gain—its best week since June. Key players like Micron Technology (MU) and Kioxia saw gains of 20-40%. Next week will be quieter in terms of earnings, with attention on OpenAI’s Developer Day.

Healthcare

The healthcare sector had a transformative week, driven by the MFN drug pricing deal with Pfizer (PFE), resulting in a broad rally across pharmaceuticals and tools. The sector's strong performance was also supported by emerging details regarding FY26 STARs and positive margin trajectories for managed care companies.

Consumer

Debate around the health of the consumer has intensified, particularly following underperformance in retail stocks. Weather impacts on fall apparel sales are contributing to concerns, although investor sentiment remains constructive.

Financials

Inquiries regarding financials have surged, influenced by cyclical risks and recent negative headlines surrounding private credit. As we approach Q3 earnings, key themes include net interest income outlook, elevated trading revenue, and capital returns.

Industrials

Industrials gained 180 basis points this week, outperforming the broader market. Defense technology stocks led the charge, while data center-related companies continued to show strength amid favorable AI data.

Energy

Energy stocks faced challenges, with Brent crude down 8% and equities down 3%. However, there is growing interest in natural gas equities as we enter the storage season, with expectations of a colder winter boosting valuations

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!